Who Pays for Long-Term Care?

When a loved one needs long-term care, one of the first and most pressing questions is: How are we going to pay for it? The answer isn’t always straightforward. Long-term care can be expensive, and most people are surprised to learn that their existing health coverage, like Medicare, doesn’t cover the bulk of these costs.

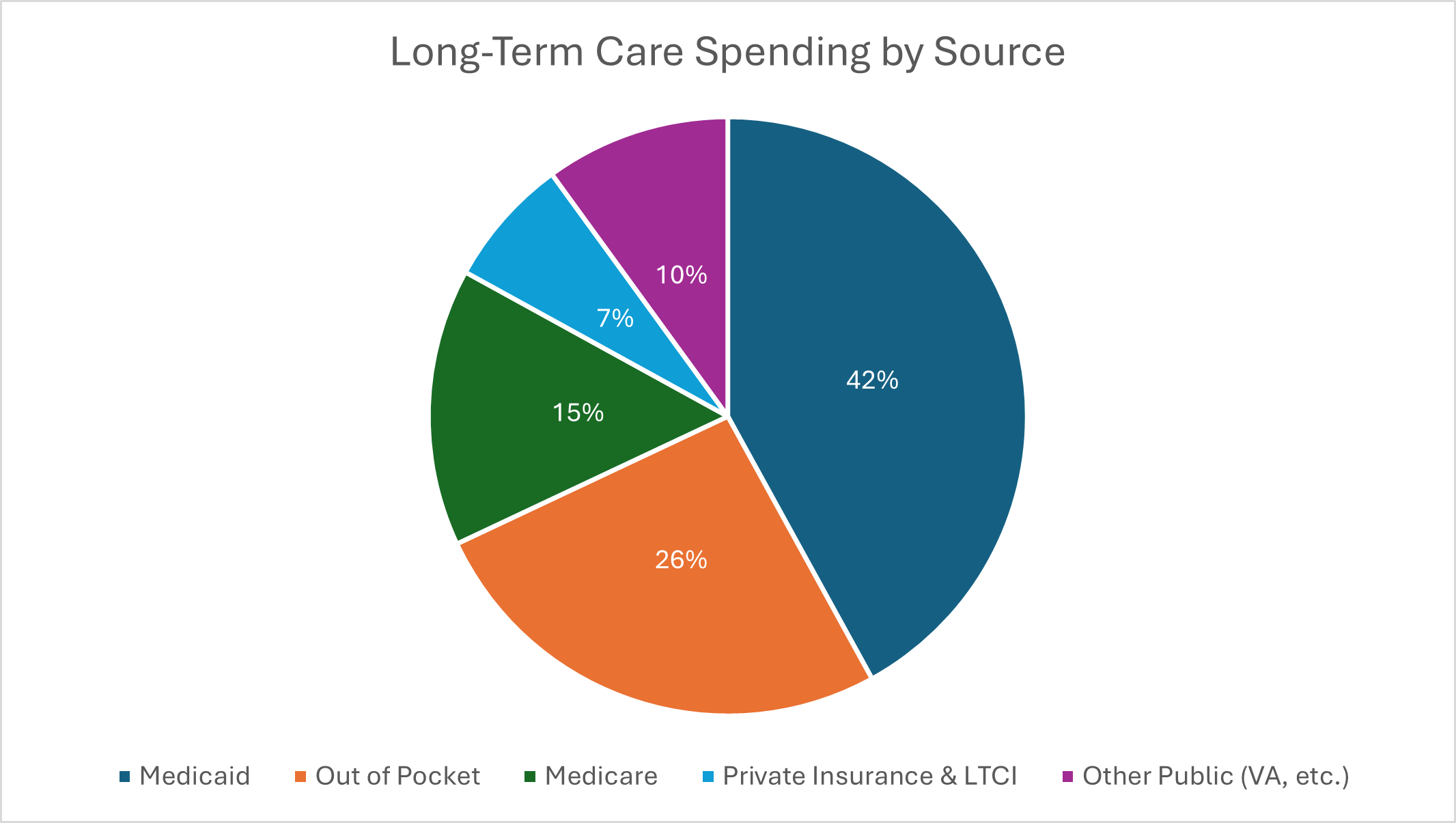

Understanding who pays for long-term care is essential for proper planning. Below is a breakdown of how long-term care expenses are currently paid in the United States:

Source: U.S. Department of Health & Human Services, 2023 data

Medicaid: The Largest Payer—But with Strings Attached

Medicaid covers the largest share of long-term care costs in the U.S. To qualify, individuals must meet strict income and asset limits, often requiring them to spend down much of their savings first. In many cases, Medicaid also limits where you can receive care—typically to nursing homes or facilities that accept Medicaid, which can reduce your flexibility and options.

Out-of-Pocket: The Most Costly Route

More than a quarter of long-term care expenses are paid directly by individuals or their families. This means dipping into retirement accounts, selling assets, or relying on adult children to cover monthly costs. For those who haven’t planned ahead, this is often the default scenario. Unfortunately, it can take a serious toll on family finances.

Medicare: Limited and Short-Term Coverage

Many people assume Medicare will cover long-term care, but it only pays for short-term skilled care and only in specific scenarios, typically following a hospital stay. If you need help with daily activities like bathing, dressing, or eating for an extended period, Medicare does not cover those services.

Private Insurance & Long-Term Care Insurance

Only about 7% of long-term care expenses are covered by private insurance, which includes long-term care insurance (LTCI). LTCI is one of the few ways to proactively plan for long-term care and maintain choice, control, and independence in how and where care is delivered. Unlike Medicaid, LTCI allows you to access home care, assisted living, and nursing facility care on your own terms without depleting your assets.

Veterans Affairs (VA) Benefits

The Department of Veterans Affairs offers certain long-term care benefits to eligible veterans and their spouses, but access can be limited based on service history, income level, and availability of VA facilities. Plus, it only covers a small portion of care costs. While this can be a valuable resource, it is limited and not a guaranteed solution for all veterans.

Why Planning Matters

As the need for long-term care grows with an aging population, the financial burden will continue to fall on families. That is, unless a plan is in place. Understanding who pays for long-term care is the first step in protecting your future.

Long-term care insurance helps shift that burden, preserving your savings and giving you more flexibility in how you receive care. It’s a smart way to plan ahead—so that you and your family don’t have to scramble later.